Swiss Watch Exports in July 2025: A Market on the Edge of Change

Swiss watch exports rose in July, driven by US stockpiling, while Asia's growth slowed, as Spain expanded, and Ireland declined.

The world of Swiss watchmaking is often described as timeless. Yet, behind the sparkle of polished cases and the weight of horological tradition, the industry is never still.

The latest figures from July 2025 reveal a fascinating landscape, one shaped as much by geopolitics and trade manoeuvres as by consumer passion for craftsmanship.

Swiss watch exports rose by 6.9% year-on-year, reaching close to 2.4 billion francs. At first glance, this appears to be a confident step forward.

But beneath the headline number lies a more complex story: without the United States, which saw a staggering 45% surge, global exports would actually have slipped slightly into negative territory.

United States: A Rush Before the Storm

The sudden jump in exports to the US is less about a surge in consumer demand than it is about anticipation.

With the spectre of higher tariffs looming, many brands rushed to ship stock across the Atlantic, ensuring their timepieces were safely on American soil before any customs duties could bite. It is, in other words, a front-loading strategy, more of a stockpile than a sales boom.

This creates an odd paradox: the US now accounts for nearly a quarter of Swiss watch exports, its highest share in recent memory, yet the numbers may not reflect the true health of demand in boutiques from New York to Los Angeles.

Asia: A Market Losing Momentum

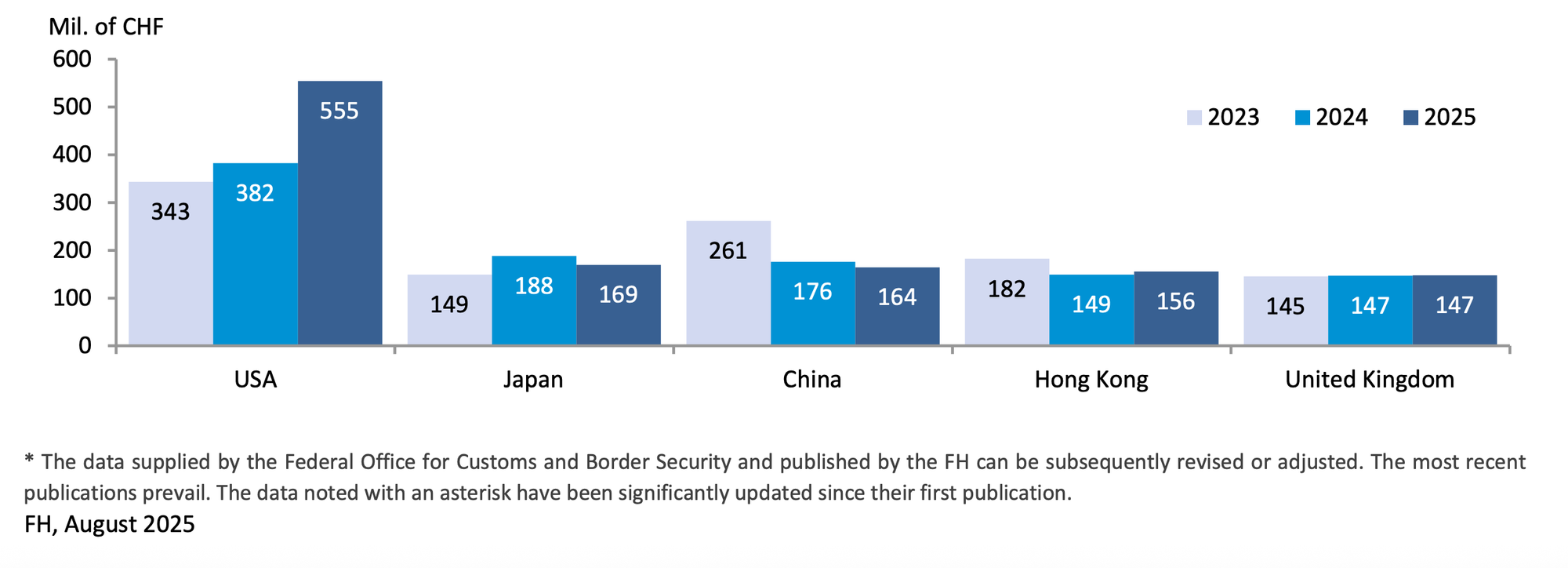

The other major markets painted a more sobering picture. Japan fell by 10.1%, while China slipped by 6.5%, continuing a downward trend that has seen it lose more than a third of its Swiss watch imports compared to two years ago.

Even Hong Kong, once the beating heart of luxury watch distribution, eked out only a modest 4.6% rise.

Singapore was the bright spot in the region, with a 14.8% jump, suggesting that the city-state is increasingly acting as a hub for high-end collectors and regional buyers.

Materials and Prices: Shifts in Taste

Interestingly, the data also reveal changing preferences in materials and price brackets.

Stainless steel and bimetal watches posted strong gains in both volume and value, while precious metals held steady. Watches made from alternative materials, however, slumped by over 20% in volume, hinting that consumers are gravitating back towards classic choices.

On pricing, the strongest growth was in the middle and upper tiers. Watches priced between CHF 200 and 500 and those above CHF 3,000 recorded solid increases, while the entry-level segment (below CHF 200 export price) shrank.

For an industry that thrives on prestige, this shift is telling: the watch remains not merely a timekeeper, but a statement of aspiration and achievement.

Europe: Stability Amid Shifts

Closer to home, the picture was mixed. The UK remained steady at +0.2%, France saw a modest rise, while Germany and Italy both contracted.

Ireland, however, told a more nuanced story: July alone saw a sharp 20% fall, but from January to July the country actually held up well, posting a slight increase compared to both 2024 and 2023, suggesting a short-term blip rather than a collapse in demand.

Spain, by contrast, has been consistently strong, up nearly 12% year-on-year, while Sweden posted one of the most striking gains of the period (from January to July), leaping 23% and highlighting how even smaller European markets are playing a growing role in sustaining Swiss exports.

The Gulf region, meanwhile, showed resilience, with the UAE and Saudi Arabia maintaining growth, supported by a strong appetite for luxury goods.

A Market in Flux

What emerges from July’s figures is a portrait of an industry navigating uncertainty. The US boost masks underlying fragility elsewhere, particularly in Asia.

The strength in higher price segments suggests that luxury remains resilient, but it is increasingly concentrated among established markets and discerning buyers.

For watch lovers, this flux is not necessarily a bad thing. Periods of tension often spur creativity, new models, bolder designs, and more innovative ways of engaging collectors.

Swiss watchmaking has weathered crises before, from quartz revolutions to global recessions, and has always emerged with renewed vigour.

As we head into the latter part of 2025, the question is not whether people will continue to covet finely crafted watches; they will, but rather which markets and which styles will define the next chapter of horology’s story.